MyPortal - my online selections

Use this procedure to display or change how you receive your Forms W-2. By default, you will receive your Form W-2 in paper format in the mail. You can also display historical Forms W-2 electronically and in PDF format using the My Tax Forms tile.

By changing your online selections to “Online”, you will no longer receive a paper W-2 in the mail. You will have the ability to change back to a paper form at any time prior to the end of the calendar year.

STEP 1

Click the My Online Selections tile.

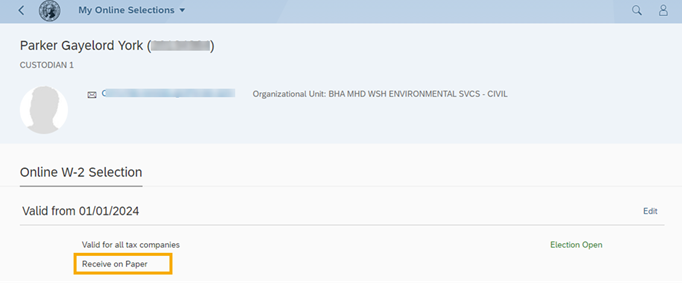

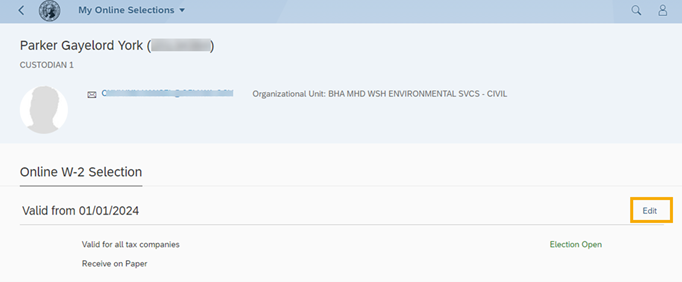

You will see the current status of your online selections for Forms W-2.

STEP 2

Click Edit to change how you receive your Form W-2.

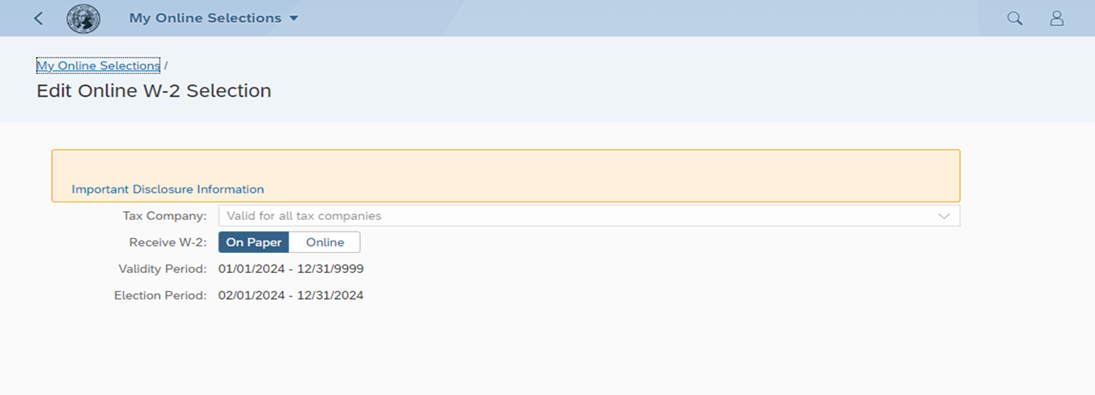

The default setting will be On Paper. This means you will receive a paper Form W-2 in the mail and you will also be able to view your Forms W-2 online.

STEP 3

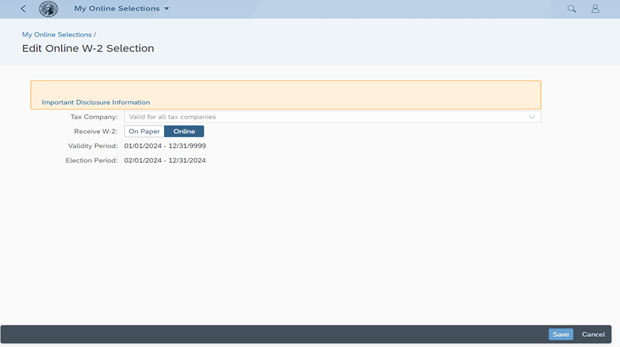

Click Online and Save.

Be sure to view Important Disclosure Information from the yellow banner prior to changing your election to Online only.

By choosing Online, you will not receive a mailed Form W-2. Select On Paper to change back to receiving a mailed Form W-2 by the end of the calendar year.

If you have already made an online-only selection in a previous year and do not wish to change it, you do not need to create a new election.

You can still view your Forms W-2 online and pdf format even if you’ve selected On Paper.

The Validity Period is the time period your Online or On Paper selection will be effective.

The Election Period is the timeframe you have during the year to make changes to your Online or On Paper selection.

If you have already made a selection in My Online Selections, “Election Closed” will display. If you decide to change your election for the current year, it will change to “Election Open”. You can change your election up until 12/31 of the tax year.

If you separate from state service, your Online W-2 selection will automatically change back to On Paper and you will receive a paper form in the mail when Forms W-2 are next distributed.

Tax Company defaults to “Valid for all tax companies”. No other options are available so the dropdown menu will not work for this field.